Private Limited Company (Pte Ltd)

There are five main types of business entities, each with its own characteristics: Generally, a private limited company is the most common business entity set up in Singapore. What is…

There are five main types of business entities, each with its own characteristics:

- Sole Proprietorship (SP)

- Private Limited Company (Pte Ltd)

- Limited Liability Partnership (LLP)

- Limited Partnership (LP)

- Public Limited Company (Ltd)

Generally, a private limited company is the most common business entity set up in Singapore.

What is a Private Limited Company (Pte Ltd)?

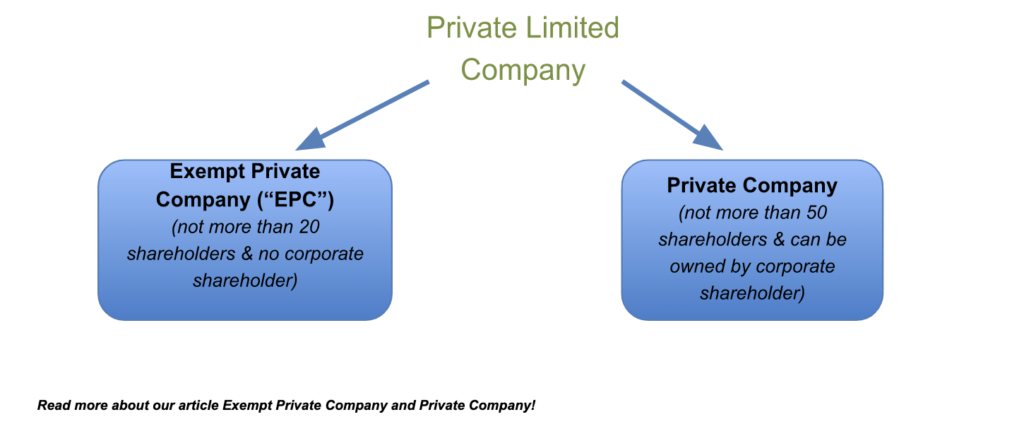

The Singapore private limited company is a business entity registered in Singapore with the Accounting and Corporate Regulatory Authority of Singapore (ACRA). The shares of a private limited company are not offered to the public. The shareholders of a private limited company can have no more than 20 members or less, and no corporation holds a beneficial interest in the company’s shares (Exempt Private Company) or not more than 50 members (Private Company).

An Exempt Private Company (EPC) is a company registered in Singapore which has fewer than 20 shareholders and is usually not listed on any stock exchange in Singapore. Unlike a private limited company, an EPC does not need to hold annual general meetings or submit audited financial statements (but it’s still encouraged to do so).

On the other hand, a Private Company is any incorporated business entity in Singapore which can be owned by a corporate shareholder and can have up to 50 shareholders. Private companies must hold annual general meetings and submit audited financial statements for public scrutiny.

What are the characteristics of a Private Limited Company?

- Separate legal entity from shareholder/(s) and director/(s)

- Can have more than one shareholder

- Limited liability

- Can own property in its own name

- They can sue and be sued

- Perpetual succession

- Taxed at corporate rates

What are the pros and cons of registering a Private Limited Company?

Some of the advantages of registering a private limited company in Singapore are:

- Limited Liability: The shareholder’s liability is limited to their shares in the company. This means that they will not be held personally liable for the debts of the company.

- Foreign Investment Welcome: Foreigners can own up to 100% of the shares in a Pte Ltd. There is no restriction on the nationality of shareholders.

- Favourable Tax Rates: Pte Ltd companies are taxed at corporate tax rates, which are lower than the personal tax rates.

- For Sole Proprietor, Limited Partnership, and Limited Liability Partnership, owners and partners must top up Medisave for business renewal. Whereas private limited companies have no requirement to top up Medisave.

- Easier to transfer ownership by selling partial or all its share

- Easier to raise funds by issuing new shares to new investors

The disadvantages of setting up a private limited company in Singapore:

- Cost of formation: Slightly a higher cost to register a private limited company compared to a sole proprietorship or partnership

- Yearly filing requirement: A private limited company in Singapore must file annual returns and financial statements with ACRA.

- More compliance and disclosure obligations by ACRA and IRAS

Conclusion

A Pte Ltd company is the most common and suitable choice for businesses looking for limited liability protection and favourable tax rates. However, the higher cost of formation and compliance burden should be considered before making a decision.

Speak to us today for the best professional recommendations to safely set up your Private Limited Company.

+65 6221 1768

+65 6221 1768