Professional PayRoll Services

Our payroll services streamline employee compensation for businesses, offering benefits such as automatic payouts, accurate tax calculation, time off tracking, and preparation of pay slips and IR8A forms. This not only saves time and money, but also provides a systematic and organized approach to staff remuneration.

Get In Touch

Personalised Attention to your PayRoll Needs

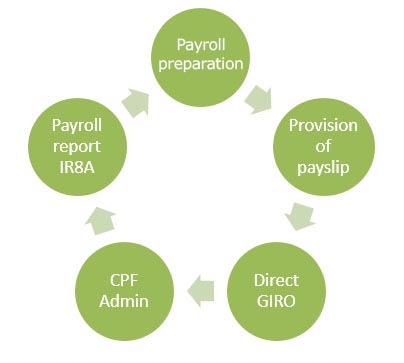

Aura Partners provides top-notch payroll services to help clients save time and resources while adhering to Singapore's statutory requirements. Our services allow clients to focus on expanding their business and enhancing customer satisfaction. Our services include:

- Payroll calculation and preparation, including deductions for overtime, CPF, and other benefits.

- CPF application and administration, with monthly submissions to the CPF Board.

- Multiple salary payment options, including GIRO or cheque.

- Payslip preparation and delivery, either by email or office.

- Preparation and submission of CPF contribution reports to the CPF Board.

- Preparation of payroll reports and IR8A forms.

- Tax clearance for foreign employees working in Singapore.

Choose Aura Partners, a reliable Singapore accounting firm, for your company's payroll needs.

Clients That Trust Us

Reviews

Why Use Aura Partners Payroll Services

Our experienced payroll team in Singapore provides a complimentary business assessment and consultation to fully understand your business needs before starting our comprehensive payroll services. This includes evaluating your business processes, compliance with the CPF Board, Ministry of Manpower, and overall business needs, and providing expert recommendations for improving documentation and control processes.

Frequently Asked Questions About PayRoll Services

It depends on whether you need full-scale or partial payroll services. Your preference for a provider of these services in Singapore can also impact the cost.

Monthly outsourcing payroll service start from as low as S$35 per month.

The full range of payroll processing services includes timely employee salary payment; handling data, deductions, and claims; tax reporting and filing, etc.

In-house payroll can be viable when a business has a small number of employees, simpler payroll structures, enough time and resources to dedicate to it, and the expertise or access to payroll software needed for accurate calculations and compliance. However, as the business expands or if payroll complexities increase, outsourcing to a payroll company might become more efficient and cost-effective.

- Processing inaccurate information

- Processing payments late

- Misclassifying employees

- Not keeping up to date with regulatory changes that affect how payroll is processed.

- Not tracking overtime hours properly or miscalculating overtime wages.

- Overlooking CPF submission and payment deadlines.

- Keeping track of deadlines

- Create written policies.

- Keep complete records.

- Improve time and attendance.

- Classify employees correctly.

- File on time.

- Improve your payroll system.

- Upgrade your payment method.

+65 6221 1768

+65 6221 1768